I Bonds are great for maximizing returns on money held in emergency funds. These saving bonds are backed by the U.S. Government (100% safe) and indexed to inflation. Not only do I Bonds have higher interest rates than money market funds and CDs, but all interest is also free from state and local income taxes and tax-deferred at the federal level.

I started to move my emergency fund into I Bonds a few years ago. I highly recommend that everyone with a long-term emergency fund do the same.

Emergency savings

Most financial advisors and finance blogs say people should maintain a six-month emergency fund for various reasons (job loss, financial emergencies, etc). The standard advice is to keep this money in a high-interest rate saving account. The problem with this advice is that these accounts no longer exist! Good luck finding an account that will pay a “high-interest rate” or even anything over 1%.

In today’s environment, savings accounts return almost nothing. With high yield personal accounts paying interest rates of 0.25%, it’s best to look for other ways to hold cash. This is where Series I Savings Bonds come in (also known as I Bonds). Currently, these bonds earn 3.54%!

I Bonds are great for emergency funds

If you want to hold cash, I Bonds offer a lot of benefits.

#1. I Bonds are indexed to inflation. These bonds work to protect your money during times of higher inflation like we’re experiencing now.

#2. These are US government bonds. As such, I Bonds are tax-free at the state and local level and tax-deferred at the federal level.

Individuals can invest $10,000 a year in I Bonds. For families, you can invest $10,000 for everyone with a social security number. Meaning that a family of 5 can buy $50,000 per year.

At $10,000 per year, moving your emergency account to I Bonds could take a few years, but it’s worth it in the long run.

One key item to consider is that I Bonds require a one-year lock-up period. This is when your money is essentially locked in the bonds, and you’re unable to access it. If you’re converting your emergency fund over to I Bonds, this is something that you need to pay attention to, as you don’t want too much of your emergency fund inaccessible at once.

After all, this is an emergency fund, and you never know when an emergency may happen.

How are I Bond interest rates calculated?

Series I Savings Bonds are individual savings bonds that earn interest, based on combining a fixed interest rate and a rate for inflation. These two different rates are calculated and added together to provide the return of the bond. Both rates adjust twice a year, on May 1st and November 1st.

Interest Rate = Fixed Interest Rate + Inflation Rate

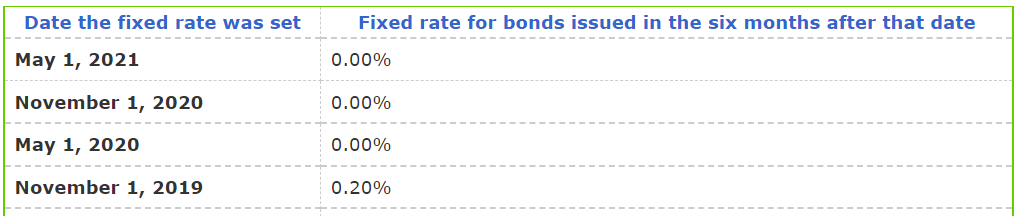

Fixed interest rate

The fixed interest rate component sets at the date of purchase and remains the same for the life of the bond. So if you bought a bond today with a fixed rate of 0.0%, the fixed rate will remain 0.0% for the lifetime of the bond.

The fixed-rate component ensures that the bond remains competitive vs other bonds in the open market. While not much of a concern in the current market environment as interest rates are very low, when I Bonds were first launched in 1998, this fixed-rate component played a very important part in attracting buyers.

In the late 1990s, interest rates were much higher than they are now. For instance, a 30 year US Treasury Bond purchased today yields just under 2%. Meanwhile, a Treasury bond bought in 1998 paid about 5.6% on average. This is a big difference, especially considering 30 years of compound interest.

The current fixed interest rate is 0.0%. It’s been this low since May 2020.

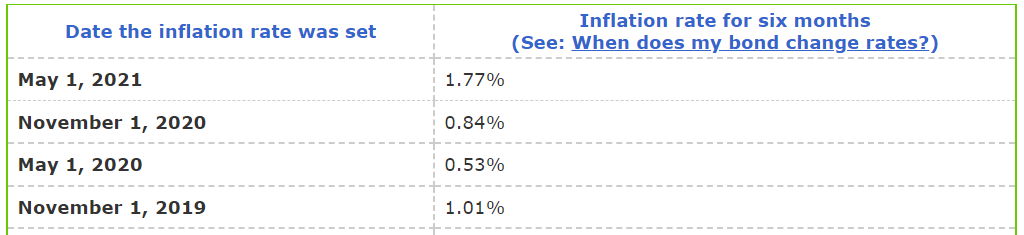

Inflation rate

The inflation rate is a variable rate that changes over the lifetime of an I Bond. The inflation rate is based on the Consumer Price Index for all Urban Consumers (CPI-U). This rate updates every six months, on May 1st and November 1st.

The inflation rate component is the key piece that:

- Protects your money adjust inflation

- Currently provides a higher bond return than anything else on the market

The current 6-month inflation rate (in July 2021) is 1.77%. This is over 3.5% annually.

Is interest tax free? When is it paid?

There are some important things to note about I Bond interest.

#1. Interest is tax-deferred, and can be deferred for 30 years! Because interest is accumulated and not paid out as earned, taxpayers are not required to pay income tax on these earnings until they cash out the bond.

#2. Interest is tax-free at the state and local levels. As these bonds are issued by the US government, they’re exempt from state and local income tax.

#3. Interest is earned monthly and compounded semiannually. This means that interest is added to all account balances every 6 months (May and November). Interest for the next 6 month period is then earned on the new, larger balance.

Tax-free, compound interest baby!

How much can I invest in I Bonds annually?

I Bond purchases are capped at $10,000 per year per person. So a family of four can buy $40,000 worth of I Bonds a year.

You must have a social security number to buy I Bonds.

While $10,000 is a lot of money to most people, this $10k cap significantly limits the amount of I Bonds an individual can buy in a single year. This is something worth considering as you near retirement. I assume that most people pursuing Chubby FIRE would like to take advantage of these bonds. Doing so properly takes foresight, as most will plan to purchase these bonds over a period of several years (if not longer).

How long do I need to hold an I Bond before I can redeem it?

I Bonds are long-term saving vehicles. Because of this, they must be held for 1 year after purchase before they can be redeemed.

How do I buy I Bonds?

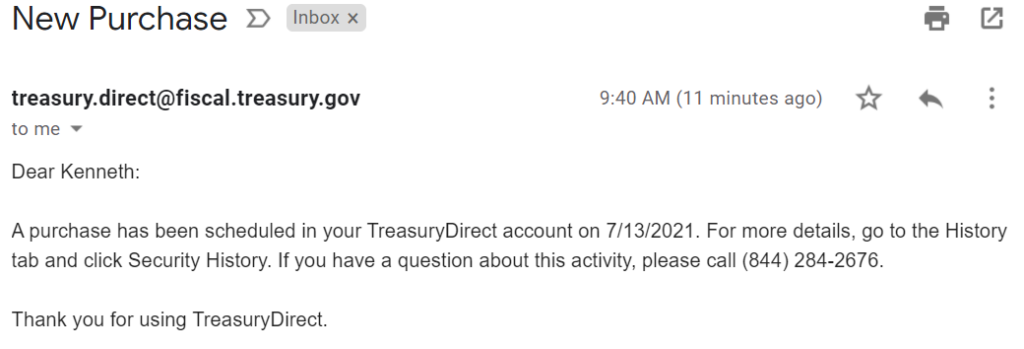

The easiest way to purchase I Bonds is online through TreasuryDirect. TreasuryDirect is a government website where people can buy and redeem Treasury securities directly from the U.S. Government.

Creating an account with them is easy, and once you do you’ll be able to buy I Bonds, Tips, and several other government securities directly from the US Department of the Treasury.

TreasuryDirect is similar to an online broker, so you can buy and sell bonds directly through the site, and never have to handle any paper.

Now if paper is your thing, you can also still buy paper I Bonds through the mail when you file your federal income taxes. But who wants to do that?

Why have I never heard of I Bonds before?

Most people have never heard of I Bonds. There are several reasons for this:

- They’re only sold by the US Government. Meaning the banks and financial advisors don’t deal in I Bonds and therefore tend to ignore them.

- The annual $10,000 limit makes this of little interest to the very wealthy.

- I bonds are purchased and redeemed by individuals directly with the government. Therefore these bonds can’t be traded, so there is no secondary market for these assets. The lack of a market where people can trade these bonds means traders and banks can’t profit off them. It also means there is very little news about these bonds. In fact, the only time I Bonds get any new coverage is around the two times a year when their rates reset.

My personal investment strategy

Before discovering I Bonds, I held most of my emergency cash in a high-interest savings account with E*TRADE.

Once I learned about I Bonds, I decided to slowly transfer money into them to keep most of my emergency fund easily accessible.

I started by buying $1,000 in I Bonds every month or two. This way, I’m slowly converting my emergency fund into I Bonds, and the only risk not having access to about $10,000 at a time.

Plus as each $1,000 bond hits the one-year mark, I get the ability to redeem it. So if I need the money, most of my I Bonds are redeemable right away, and on average, I’ll be able to redeem an extra $1,000 about once a month.

While this may be too conservative (or aggressive) for some, I’m happy with this approach. So far, I’ve never needed to access my emergency fund, but I like knowing that the money is there (and earning a decent return).

Summary

In conclusion, I Bonds are awesome financial assets for emergency funds. They have high-interest rates, tax benefits and after 1 year, your money is fully accessible. Because these products are so good, the government only allows you to buy $10,000 a year. That’s why you should look into moving your emergency fund into I Bonds today, as it could take several years to fully convert.

i wonder if interest rates have reached their peak or are dropping again